Advocacy Action Alert

Please urge your State Lawmakers to SUPPORT the Historic Preservation Tax Credit “Repair” Bill

Wisconsin’s Historic Preservation Tax Credit (HTC), initially created in 1989 to enhance the federal HTC credit, not only helps preserve Wisconsin’s architectural heritage, but it also plays a key role in driving economic development across the state. Under current state law, eligible historic preservation projects can receive a state income tax credit of 20 percent of the qualified rehabilitated expenditures up to $3.5 million.

However, several changes over the years to both the state and federal tax credit programs have created unintended confusion and eligibility obstacles that have delayed or “killed” historic rehabilitation projects, especially smaller projects.

The Historic Preservation Tax Credit “Repair” Bill (Assembly Bill 375 and Senate Bill 382), recently introduced at the State Capitol, would modernize the state’s HTC program by making the program more accessible, flexible, and impactful.

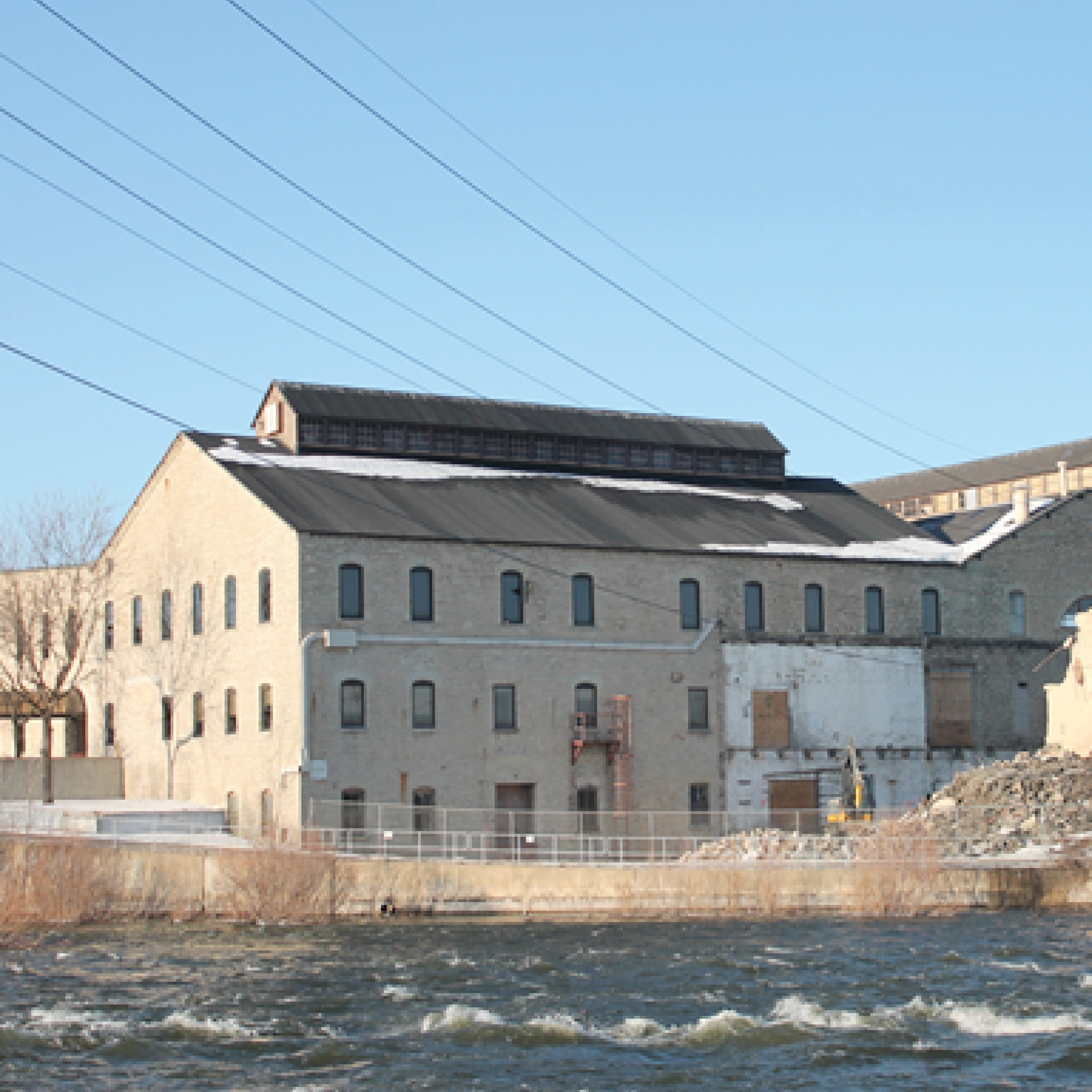

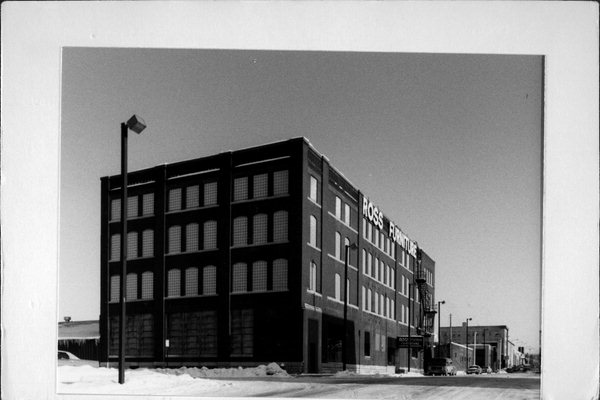

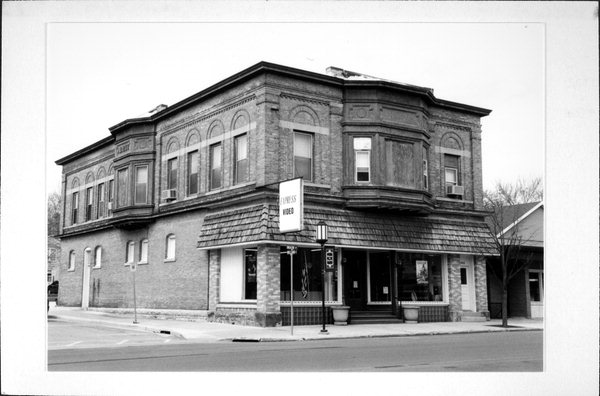

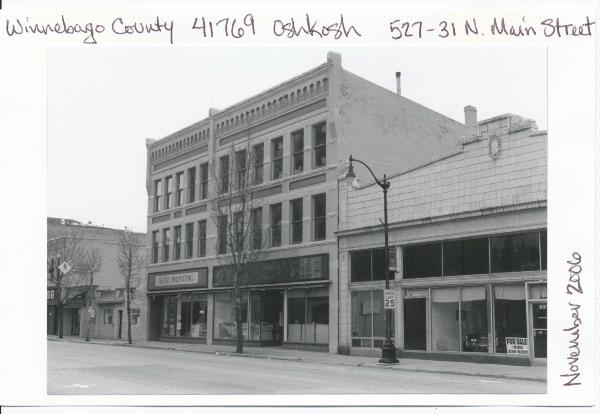

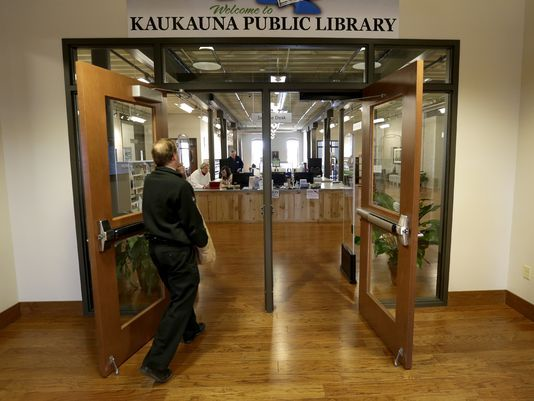

By aligning state policy with the needs of smaller-scale projects and accelerating project financing, this legislation will help ensure Wisconsin’s historic buildings remain vital community assets while driving economic revitalization. The bill recently received public hearings before two key legislative committees, but it has yet to be acted on by the full Legislature.

To build support for this important legislation and help push it over the finish line, please email your state lawmakers TODAY and urge them to SUPPORT the Historic Preservation Tax Credit “Repair” Bill.

How You Can Help

Contact your state lawmakers and urge them to SUPPORT the Historic Preservation Tax Credit “Repair” Bill (AB 375/SB 382). Simply cut-and-paste the linked sample email - feel free to personalize - and send to BOTH your state Representative and state Senator. Find local state legislators and lawmakers here.

Thank you for advancing the Wisconsin Trust for Historic Preservation’s legislative advocacy efforts to enhance an already successful program – and ultimately help preserve historic assets, revitalize communities, and strengthen local economies across the state.

Bill Overview

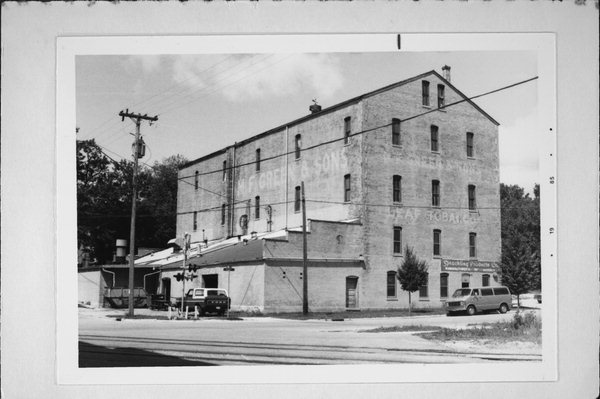

Assembly Bill 375 / Senate Bill 382 aims to strengthen the state HTC and better serve historic structures that embody Wisconsin’s cultural heritage and community identity. These historic buildings are anchors of local character, tourism, and pride. By lowering administrative barriers and expanding eligibility, this legislation will allow more of these irreplaceable landmarks to be preserved for future generations. The bill will make the following changes to the current program:

To qualify for the state credit under current law, a project’s qualified rehabilitation expenditure must be at least $50,000 AND meet the federal requirement that rehabilitation costs be greater than the building's adjusted basis. A building’s adjusted basis value can be quite large, pricing smaller projects out of the program. AB 375/SB 382 stipulates the federal requirement does NOT apply to projects seeking only the state tax credit, while maintaining the $50,000 threshold. This allows smaller projects, often found in distressed urban and rural areas, to qualify.

Under current law, the state credit is claimed over five years, which aligns with the federal schedule. AB 375/SB 382 allows the entire state credit to be claimed in one year, increasing the impact of the tax credit and expediting return on investment.

Under current law, the state tax credit is capped at $3.5 million for all projects undertaken on the same parcel. AB 375/SB 382 retains the tax credit cap, but only within a rolling 10-year window. This will allow properties to take advantage of the state credit for future rehabilitation after a 10-year period expires.