Letter sent to Milwaukee Common Council on December 4, 2025 in support of permanent historic designation of the Milwaukee Auditorium and Milwaukee Arena

Milwaukee Common Council

200 E. Wells Street

Milwaukee, WI 53202

RE: Support for Permanent Historic Designation – Milwaukee Auditorium & Milwaukee Arena (412 West Kilbourn Avenue; CCF 250995)

Dear President Pérez and Honorable Members of the Common Council:

On behalf of the Board of Directors of the Wisconsin Trust for Historic Preservation, I would like to congratulate the Common Council for supporting the permanent historic designation of the Milwaukee Auditorium and Milwaukee Arena.

We are firm believers that the designation process established by city ordinance reflects a core value we share with the City: the belief that when a historic public resource faces potential change, the public should have a voice. Historic designation does not prevent redevelopment or demolition; rather, it ensures that any future proposal receives the appropriate level of scrutiny, transparency, and thoughtful review. The ordinance allows the public to be heard, ensures the historic value of these properties is fully considered, and places the final decision in the hands of elected officials—exactly as it should be for buildings of such civic importance.

This balanced, transparent process is not an obstacle to progress; it is a hallmark of responsible stewardship. The Wisconsin Trust for Historic Preservation strongly believes that such an approach serves both the city’s future and its proud architectural heritage.

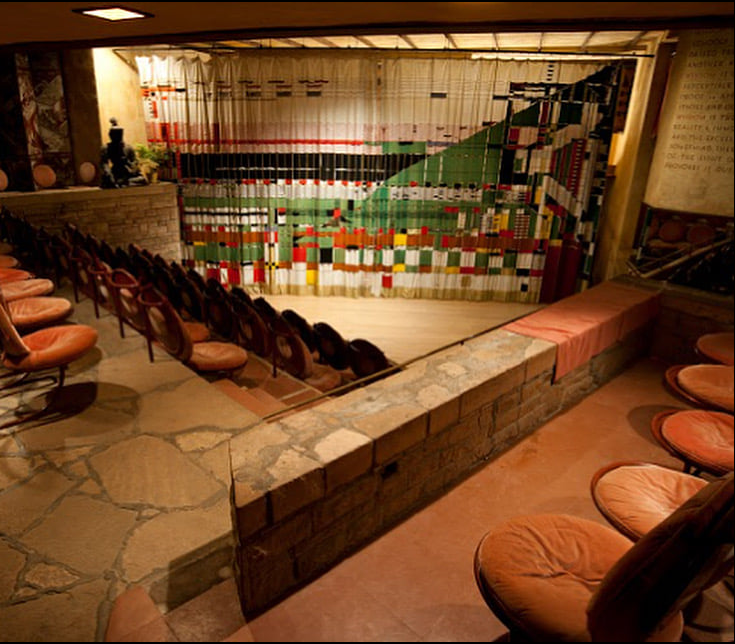

The Auditorium and Arena are among Milwaukee’s most significant cultural and civic landmarks, deeply woven into the city’s architectural legacy and public life. They have hosted the moments, gatherings, and civic milestones that help define Milwaukee’s identity, and they stand today as irreplaceable components of the historic Civic Center.

These buildings also represent the work of architects whose influence shaped the character of Milwaukee. Their architectural and historic significance—well documented over generations—makes them exactly the kind of public treasures our community has long chosen to safeguard through the City’s historic preservation ordinance.

For these reasons, we wish to congratulate the Common Council for approving historic designation for the Milwaukee Auditorium and Milwaukee Arena. In doing so, Milwaukee affirms its commitment to preserving the places that matter, while ensuring that any future change proceeds through the thoughtful, democratic process the City has long embraced.

Thank you for your leadership and dedication to the people of Milwaukee.

Sincerely,

Dan Wilhelms

President, Board of Directors

Wisconsin Trust for Historic Preservation

cc: Honorable Cavalier Johnson, Mayor, City of Milwaukee