The National Trust for Historic Preservation publishes an annual list of America’s 11 Most Endangered Historic Places with the goal of raising awareness of these vulnerable properties around the country, which are at risk of irreparable damage or destruction. The list has included over 300 sites since 1988 and has been highly successful at galvanizing preservation efforts.

Two Wisconsin places have made the list in recent years: Milwaukee Soldier’s Home (in 2011) and the Mitchell Park Domes (in 2016).

For more: Save the Soldiers Home

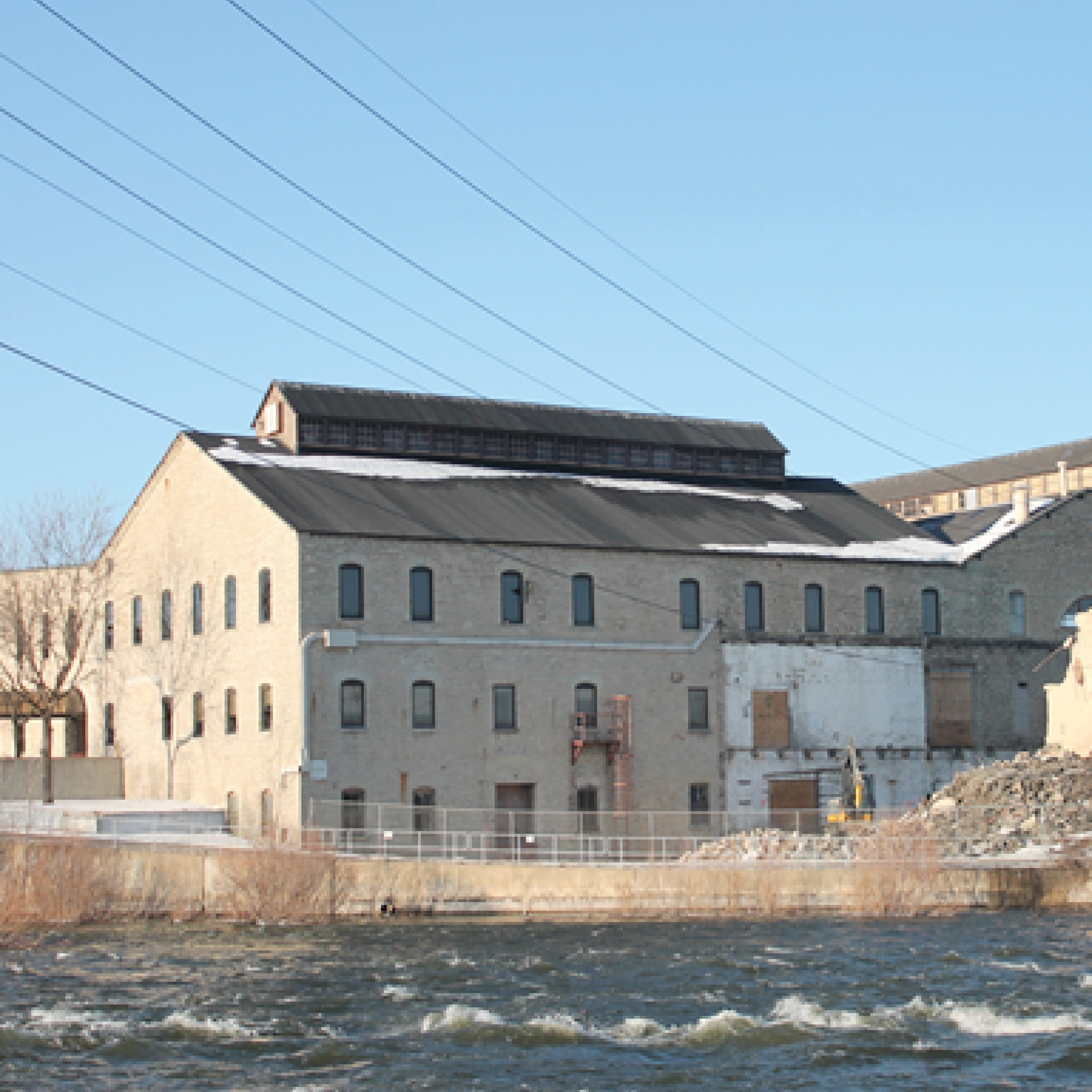

Milwaukee Soldiers Home

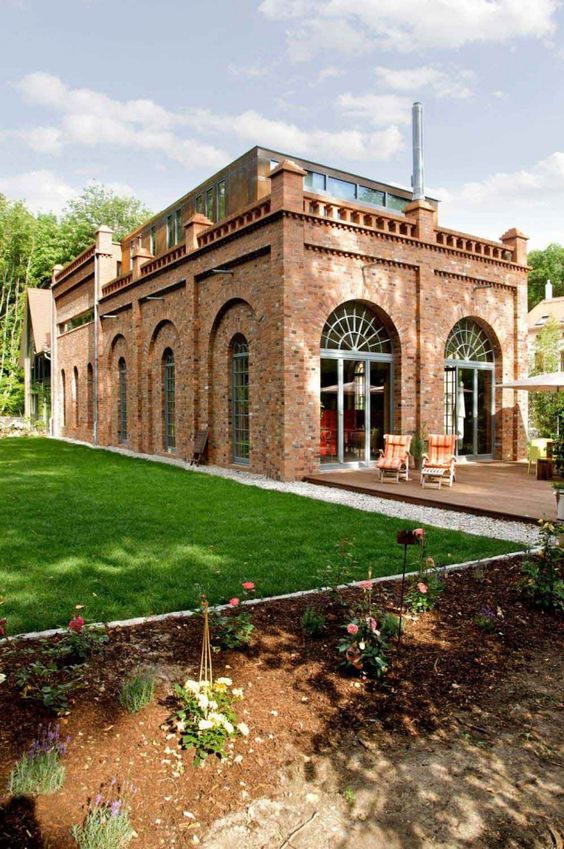

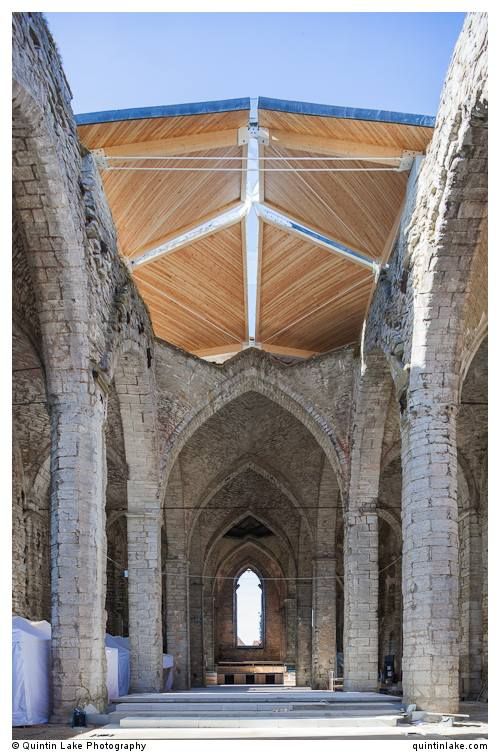

Milwaukee Soldiers Home—the most intact original VA campus in the nation and a National Historic Landmark District—after long years of deterioration, has experienced a dramatic turnaround. In March of this year, six of the historic buildings, including the spectacular Old Main, have been refurbished and reopened as supportive housing for veterans at risk of homelessness. This success was the result of collaboration between local partners and heightened publicity from the National Trust and Milwaukee Preservation Alliance.

But three other historic structures on the campus—the 1889 Chapel, 1881 Theater, and 1868 Governor’s Mansion—remain vacant and endangered. The Milwaukee Preservation Alliance received a 2020 National Trust matching grant to fund a study into viable reuse strategies for these buildings. The study will serve as a resource for the VA to develop an RFP (Request for Proposals) for the rehabilitation of these remaining treasures. This should ensure that successful reuse and preservation extends to the entire campus.

For more: Save Our Domes

Mitchell Park Domes

After its 2016 designation on the National Trust 11 Most Endangered list, Milwaukee’s Mitchell Park Domes has received an outpouring of support from the community. The #SaveOurDomes campaign succeeded in raising awareness and it appears that demolition of the beloved Domes is off the table. But despite that, subsequent progress toward concrete measures has been slow. Reports, studies, recommendations, and materials testing have been done and the County has committed to funding allocations for final analysis. But the funds were not spent in 2020 and progress in 2021 has been slow. Efforts continue to heighten public awareness and to push for definitive long-term action that will save the irreplaceable Domes.