This week, we submitted to the Public Service Commission of Wisconsin regarding PSC Docket 137-CE-221, the Ozaukee County Distribution Interconnection Project.

The Trust supports the project’s Alternate Route, which more closely follows Wisconsin’s long-standing policy preference for use of existing utility corridors and would avoid creating new impacts to historic, cultural, agricultural, and rural landscape resources.

We are sharing this letter with our community to continue the momentum as the PSC review proceeds, given the significant local and regional implications of the routing decision and the importance of ensuring that established statutory and preservation principles are carefully considered in the Commission’s deliberations.

We invite you to download and review our letter to the Public Service Commission of Wisconsin regarding PSC Docket 137-CE-221 (and see who was CC-ed on the message).

UPDATE! We’re proud to share that the National Trust for Historic Preservation joins us in supporting the Alternate Route for the proposed Ozaukee County Distribution Interconnection Project. Read their public comment submitted to the Public Service Commission of Wisconsin.

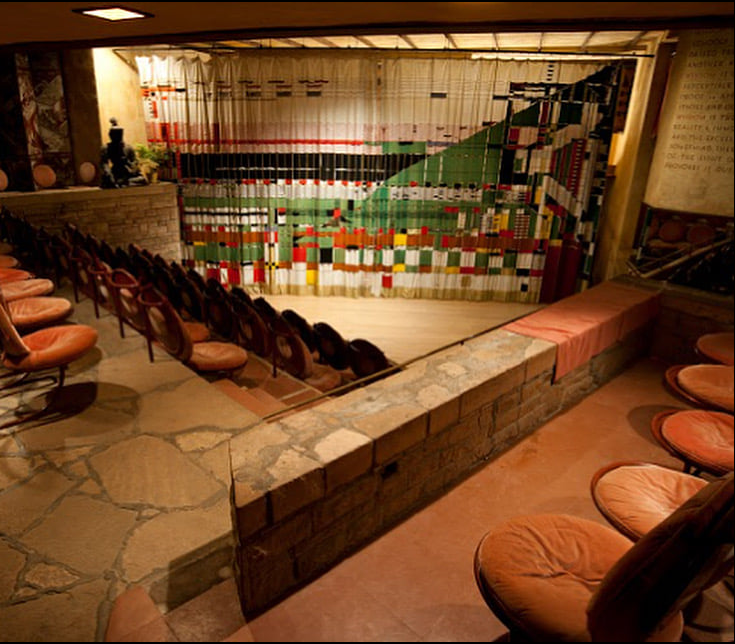

The open farmland, prairies, and historic buildings shown to the right are not empty spaces — they are living reminders of the state’s agricultural heritage, rural character, and cultural history. Once fragmented by a new high-voltage transmission corridor, landscapes like these cannot truly be restored.

While the Trust recognizes the need for reliable energy infrastructure, we support the Alternate Route, which would run largely along existing utility corridors and avoid introducing a new corridor cutting through intact rural and historic landscapes.

Wisconsin law expresses a clear preference for using existing corridors where feasible — precisely to protect places like these. Preservation is about choices. We believe Wisconsin can meet its energy needs without sacrificing irreplaceable places that define our communities and our history